Contents

Calculating sales tax can be tricky, but using our reverse sales tax calculator can easily determine your total tax. An accurate, fast, and easy reverse sales tax calculator is essential for financial clarity if you’re a business owner, accountant, or consumer.

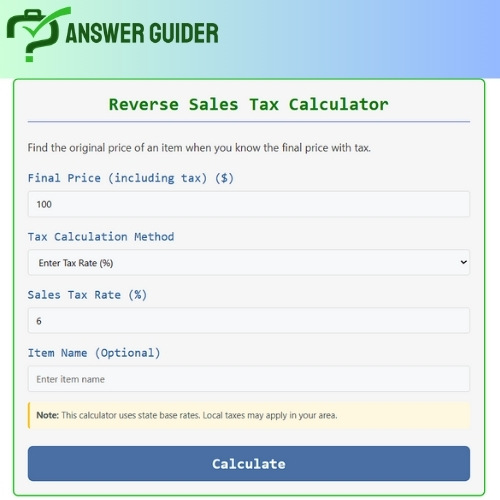

Reverse Sales Tax Calculator

Find the original price of an item when you know the final price with tax.

Note: This calculator uses state base rates. Local taxes may apply in your area.

What is a Reverse Sales Tax Calculator?

Our reverse sales tax calculator helps you determine the pre-tax price from a total amount that includes sales tax. For example, if you bought something for $107 and your local tax rate is 7%, a reverse calculator will tell you that the original price before tax was $100.

This tool is handy for:

- Small business owners

- Freelancers and contractors

- Accountants and bookkeepers

- Online shoppers

- Anyone double-checking receipts or invoices.

Why Use a Tax Reverse Calculator?

- Saves Time – No need to do the math manually

- Accurate – Avoid rounding errors and miscalculations

- Easy to Use – Enter two fields and get results instantly

- Works with Any Tax Rate – Supports U.S. state tax rates and international percentages.

- Helpful for Audits – Simplifies reconciliation and documentation

How Can You Use Our Reverse Sales Tax Calculator

Our Reverse Sales Tax Calculator helps you determine the original price of an item before tax when you only know the final price (including tax). Follow these simple steps:

Step 1: Enter the Final Price (Including Tax)

- Input the total amount you paid for the item in the “Final Price (including tax) ($)” field.

- Example: If you paid $106, enter 106.

Step 2: Select the Tax Calculation Method

- Choose between:

- Enter Tax Rate (%) (Manually input the tax rate)

- Select State (If available, pick the base rate automatically)

Step 3: Input the Sales Tax Rate (%)

- If “Enter Tax Rate (%),” type the applicable tax rate.

- Example: For a 6% tax rate, enter 6.

Step 4: (Optional) Add an Item Name

- You can enter a description (e.g., “Laptop”) in the “Item Name (Optional)” field for reference.

Step 5: Click “Calculate”

- The calculator will instantly display:

- Original Price (Pre-Tax)

- Sales Tax Amount

Important Notes

- Local Taxes May Apply: The calculator uses state base rates—check if your area has additional local taxes.

- Accuracy: Double-check the tax rate for your location to avoid errors.

The Importance of Having a Sales Tax Calculator

- Increase of Online Shopping and E-Commerce

As more businesses sell within and outside the country, the tax rates become even more complicated. A reverse calculator simplifies compliance in different jurisdictions.

- Businesses’ Financial Transparency

For audits, accounting, and pricing of products, businesses require precise tax records. Compliance issues or overpayment of taxes may result from incorrect calculations.

- Public Understanding

A reverse tax calculator illuminates the amount shoppers spend in taxes rather than just dealing with the final price presented to them.

- Amendments to Tax Laws

There are some states that 2025 may decide to introduce new brackets or exemptions, hence making manual calculations unreliable. Sales tax rates frequently change, which adds to the problem.

Conclusion

Now, more than ever, timely and precise financial tools are essential. Whether you’re a business owner, a freelancer, or someone who enjoys reconciling receipts, our Reverse Sales Tax Calculator 2025 makes it simple to obtain the actual pre-tax value of any total. With a few simple inputs, the calculator will show the user how much of the payment was paid in sales tax—making budgeting effortless, filing taxes precisely, and managing finances easily and confidently.

Stop estimating your finances and use our Reverse Sales Tax Calculator. It is free and easy to use. Calculating taxes is no longer tedious and time-consuming.

Also, you can use those calculator:

Free Ski DIN Calculator: Quick, Easy & Accurate Tool

Free Baby Eye Color Calculator – Predict Baby Eye Color

Free BTZ Calculator for Air Force Promotions

Free Chiron Calculator | Find Your Astrological Insights

FAQ

Reverse tax calculation formula in Excel?

To reverse-calculate tax in Excel, you can use a simple formula:

=Total_Amount / (1 + Tax_Rate).

For example, if the total is in cell A1 and the tax rate is 7%, the formula would be: =A1/1.07.

If you want a faster and easier way, you can instantly use our free Reverse Sales Tax Calculator to get results without formulas.

Reverse sales tax calculator Ontario?

Ontario’s combined HST rate is typically 13%.

You can easily reverse-calculate Ontario sales tax by entering your total amount and the 13% rate into our Reverse Sales Tax Calculator.

It will instantly show you the original pre-tax price and the amount of tax paid.

Reverse sales tax calculator Quebec?

Quebec uses GST (5%) plus QST (9.975%), totalling around 14.975%.

To find the pre-tax amount, enter your total and 14.975% into our Reverse Sales Tax Calculator for quick and accurate results specifically for Quebec.

How to find original price before tax formula?

The basic formula to find the pre-tax (original) price is:

Pre-tax Price = Total Amount / (1 + Tax Rate)

For example, if your total is $107 and your tax rate is 7%, then:

107 / 1.07 = $100.

Want it even easier? Use our free online Reverse Sales Tax Calculator and get instant results without doing manual math.

Reverse tax calculator Canada?

If you’re in Canada and need to reverse-calculate GST, PST, HST, or QST, our Reverse Sales Tax Calculator can help.

Just input your total and the applicable tax rate (depending on your province), and it will instantly show you the pre-tax amount.

Reverse tax formula?

The standard reverse tax formula is:

Pre-tax Amount = Total Amount ÷ (1 + Tax Rate)

This formula lets you find the original price before adding the sales tax.

You can skip the manual work using our fast, free Reverse Sales Tax Calculator for accurate results.